regulatory-notice-25-06Download FINRA is seeking industry input to help modernize its rules, guidance, and operational processes…

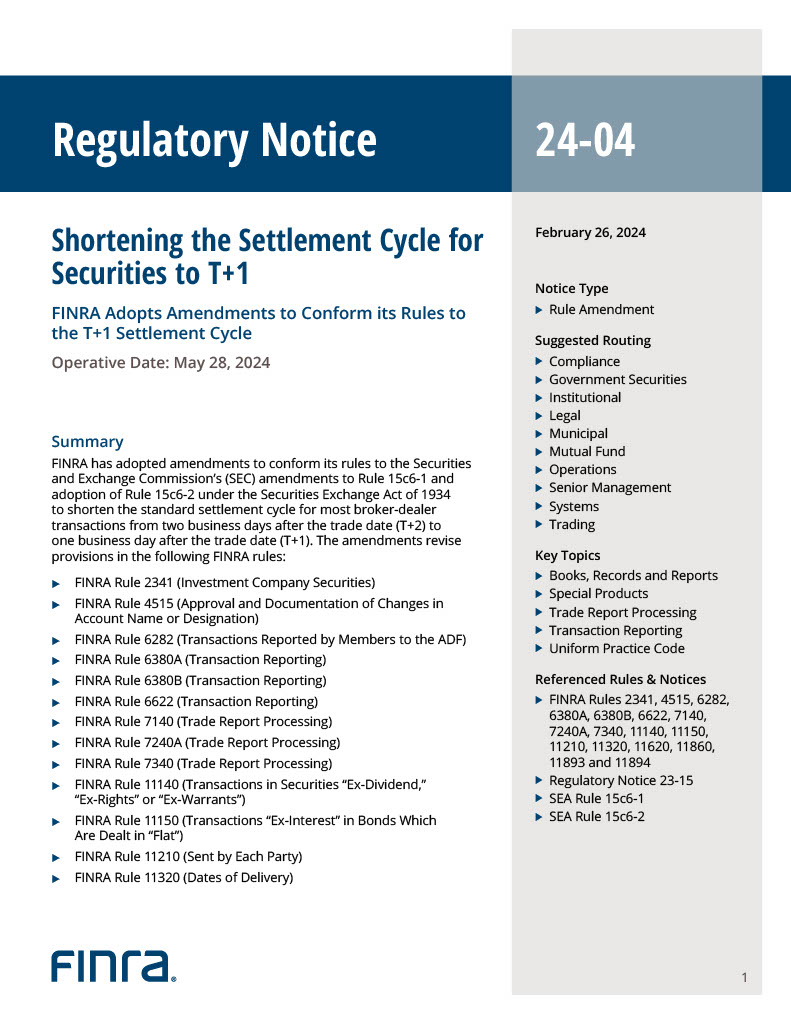

FINRA Regulatory Notice 24-04

New SEC Rules and Amendments Shorten the Standard Securities Transaction Settlement Cycle to T+1

The Securities and Exchange Commission (SEC) recently implemented new rules and amendments that aim to shorten the standard securities transaction settlement cycle to T+1. This means that instead of the current settlement cycle, which takes two business days (T+2) for transactions to be completed, it will now only take one business day (T+1).

These new rules will have a significant impact on registered broker-dealers and investment advisers. Broker-dealers, who act as intermediaries in securities transactions, will need to adjust their operational processes to accommodate the shortened settlement cycle. They will need to ensure that they have the necessary systems in place to facilitate the faster settlement of transactions. Investment advisers, who provide advice and manage investments on behalf of clients, will also be affected as they will need to revise their portfolio management strategies to reflect the shorter settlement cycle.

To comply with the new rules, broker-dealers and investment advisers will need to make several adjustments to their current business practices. For broker-dealers, this may involve upgrading their technology systems and infrastructure to support the faster settlement process. They may also need to enhance their risk management and compliance procedures to address the potential operational risks associated with the shortened cycle. Investment advisers may need to revise their investment strategies to ensure timely settlement of transactions and to mitigate market risks.

Background and the Progression to T+0

Background:

The settlement cycle refers to the time it takes for financial transactions such as the buying and selling of securities to be completed. In the traditional settlement cycle, known as T+3, it took three business days for these transactions to be settled, meaning the buyer received the securities and the seller received the funds.

Objectives:

The primary objective in the progression towards achieving a T+0 settlement cycle is to enhance the efficiency and transparency of the securities market. By reducing the settlement timeline, the goal is to mitigate market risk, enhance investor protection, and facilitate the smooth functioning of the financial system. A shorter settlement cycle can provide several benefits, such as reducing counterparty risk and increasing liquidity. It also enables market participants to deploy capital more efficiently, facilitates faster access to investment returns, and reduces operational costs associated with extended settlement timelines.

Amendments to Rule 15c6-1 – Standard Settlement Cycle

The amendments made to Rule 15c6-1 focus on the standard settlement cycle and bring about certain changes to streamline and enhance the securities market operations. Rule 15c6-1 was initially introduced to establish T+3, which means that securities transactions needed to be settled within three business days. However, the amendments now mandate a transition to T+2, wherein settlement of securities transactions must be completed within two business days.

One significant aspect of these amendments is the prohibition on broker-dealers from entering into a contract to purchase or sell any security that provides for payment of the purchase price or delivery of the security more than two business days after the trade date. This requirement aims to reduce settlement risk and expedite the overall transaction process.

Furthermore, the shortened settlement cycle for firm commitment offerings is another important change introduced by the amendments. It stipulates that broker-dealers underwriting firm commitment offerings must establish procedures to ensure that securities are promptly allocated and delivered to investors within the two-business-day timeframe.

New Rule 15c6-2 – Same-Day Affirmation

New Rule 15c6-2, also known as Same-Day Affirmation, introduces provisions and requirements aimed at improving efficiency and reducing risks in the securities settlement process. The rule specifies options available to broker-dealers to ensure timely affirmation of transactions, as well as additional requirements for written policies and procedures.

Under Rule 15c6-2, broker-dealers have three options for same-day affirmation. The first option is to establish procedures that result in settlement on the same day as the trade date. The second option is to establish procedures to affirm the details of the transaction on the same day as the trade date, with settlement occurring no later than the following business day. The third option is to enter into a standing arrangement with another broker-dealer for affirmation and settlement of transactions.

To comply with the rule, broker-dealers, investment advisers, and other industry participants must coordinate their efforts. They should identify technology systems and target time frames for affirmation and settlement, taking into account the parties involved. Additionally, broker-dealers must develop written policies and procedures to address communications and handle any delays or failures in affirmation.

Compliance Date

Compliance date is May 28, 2024.